Bonds: The Silent Market Mover

Why Bonds Matter? A Comprehensive Guide - Special Market Update Included

Investors focused solely on stocks may be overlooking the critical role bonds play in risk management and portfolio diversification.

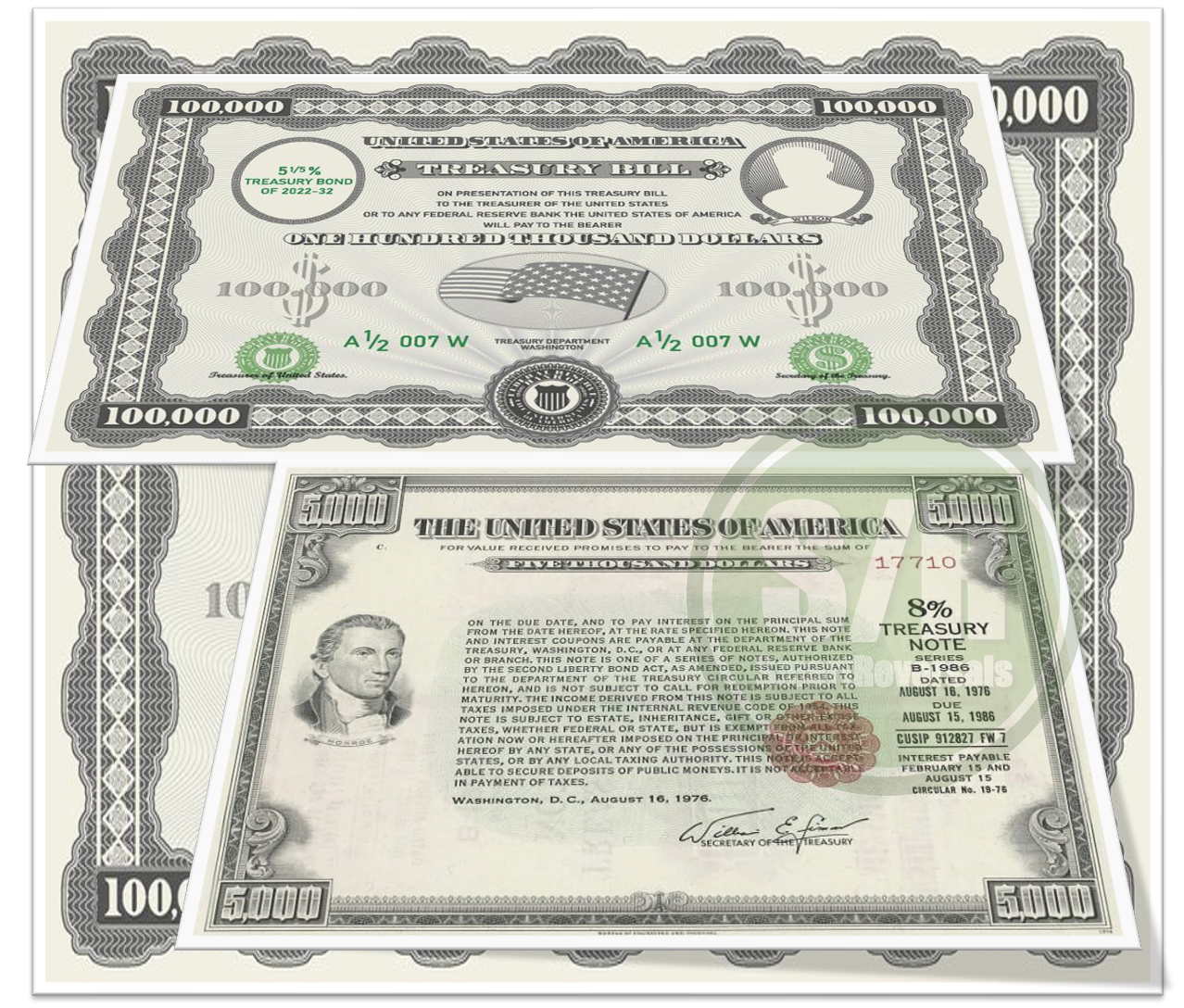

The bond market is a marketplace where individuals, companies, and governments can buy and sell debt securities, typically in the form of bonds. When entities, such as governments or corporations, need to borrow money, they issue bonds to investors. These bonds represent a promise to repay the borrowed amount, along with interest, over a specified period.

The US has the largest bond market in the world, valued at over $51 trillion, according to estimates from the Bank for International Settlements.

The relationship between the bond market and the stock market is complex but interconnected. In this edition of Level Up Your Trading the key points to consider will be studied, and before that I’ll provide a market update in this special edition.

Market Update

The $5110 level for SPX was approached, a scenario considered last Saturday but with low likelihood. However, the situation in Japan catalyzed an accelerated decline. As mentioned a couple of weeks ago, the rapid price appreciation was unsustainable, leading to today's sharp drop. This significant decline has inflicted considerable damage on the US market's structure. A measurement of the implications will be included in this edition.

The Break of the 20 Weekly Average:

By Sunday, when the futures session opened, it was quite alarming the move in Japan, anyway it was so extreme that I devised two charts, one for everyone and the second for paid subscribers, here is the update and some additional references.

Nikkei Weekly Chart Status as of Wednesday:

Price movements between volume shelves are typically rapid. Similar to the swift transitions from level C to B and subsequently from B to A, declines can be equally or even more abrupt. (Of course, level B didn't exist when the move from A occurred, but a consolidation period established the new base.)

That said, the $32,500 level could provide temporary support, with a consolidation period anticipated in this range for the next few days.

The initial resistance expected is at $36,330, and a smooth breakthrough of this level could lead to a subsequent rejection at $38,600, resulting in a downward price movement.

Yesterday's daily technical indicators for the SPX were bearish. However, a rally emerged during the futures session. The following analysis explores the technical reason for this move and the expected trajectory of the ongoing correction: